By Steve Matthews

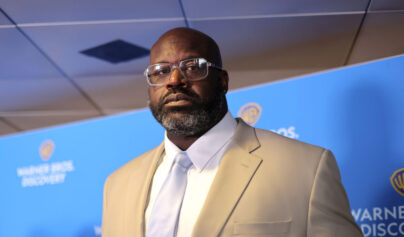

Federal Reserve Bank of Atlanta President Raphael Bostic said he favors policy makers continuing to raise rates by half-point increments rather than doing anything larger.

A half-point hike ‘’is already a pretty aggressive move,” Bostic told Michael McKee in an interview on Bloomberg Television on Monday. “I don’t think we need to be moving even more aggressively. I think we can stay at this pace and this cadence and really see how the markets evolve.”

In a later interview with Reuters broadcast on Twitter, Bostic added that he while he saw low odds for a 75-basis-point hike in the next several months, “I am not taking anything off the table.”

Fed officials raised interest rates by a half point last week and Chair Jerome Powell signaled they would continue at that pace at meetings in June and July to curb inflation, while pushing back against deploying a larger 75 basis point increase.

Critics say the U.S. central bank was too slow to tighten amid the hottest price pressures in 40 years. James Bullard, St. Louis Fed president, has said while 75 basis points isn’t his forecast, a hike of that size could be considered if needed and was successfully used by the Fed in the 1990s expansion.

“I really think we need to be getting somewhere into the neutral range,” Bostic said in the Bloomberg interview, referring to a policy that neither stimulates nor contracts the economy. “For me I am looking at somewhere between 2-2.5% as our neutral range. Then let’s wait and see what’s happening.”

Once policy reaches the neutral range, Fed policy makers could assess whether additional half-point moves are needed, or quarter point moves or no move, said Bostic, who was interviewed on the sidelines of the Atlanta Fed’s annul financial markets conference on Amelia Island, Florida.

“In my view, we are going to move a couple times — maybe two, maybe three times — see what happens, see how the economy responds, see if inflation continues to move closer to our 2% target,” Bostic said. “And then we can really take a pause and see how things are going.”

At the same time, Bostic reiterated that he was committed to doing whatever was needed to bring inflation down.

“The first thing on my mind is that inflation is too high and we need to act definitively and purposefully to try to get that under control,” he said.

‘Worried Optimist’

While a number of economists have predicted Fed tightening to counter inflation would inevitably result in a U.S. economic recession, Bostic said he was a “worried optimist” and that today’s unique circumstances following a once-in-a-century pandemic made predictions especially difficult.

Some improvement in inflation will come from the supply side, with companies doing better at boosting supplies, Bostic said. Business contacts have indicated a number of the supply chain challenges that have persisted through the pandemic are starting to show signs of easing, with for example recent demand for truckers falling, he said.

“Some of the signs we have seen recently are that, on a month-to-month basis, we are not continuing to see acceleration of inflation and that’s a good thing,” Bostic told Reuters in an interview conducted via Twitter Spaces. “Hopefully, that trend will continue as our policies start to take hold.”

Moreover, the U.S. just added more than 400,000 jobs last month, which would have been “a reason for celebration” in prior years, he said.

“There’s a lot of momentum in the economy right now,” Bostic said. “We can ride out a lot of that momentum even as we are raising rates.”

“Just to be clear, we are paying attention — I am paying attention — and if necessary we will do whatever it takes to make sure that the economy stays on a solid path,” he said.

More stories like this are available on bloomberg.com.