By Isis Almeida

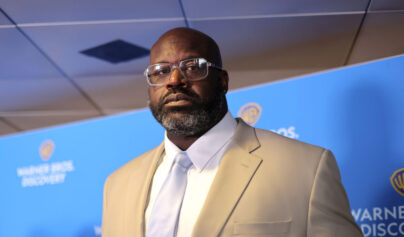

The US will avoid a recession this year as the Federal Reserve controls inflation, giving the stock market a boost, according to John Rogers, chairman and co-chief executive officer of Ariel Investments.

The Dow Jones Industrial Average will likely rally 10% or more in 2023 and the S&P 500 Index more than that, Rogers told business leaders at the Executives’ Club of Chicago’s annual outlook event. Last year he correctly forecast a sharp increase in inflation and that Bitcoin was a bubble that would burst.

“We are much more optimistic today than a year ago,” Rogers said. “The Fed is doing the right things when it comes to money supply.”

Rogers, a veteran of the fund industry, said the worst is now behind us and the bad news is baked in already. He expects the Fed will get inflation back to the 4.5% level.

His views contrast with the opinion of three top Chicago economists, who earlier this week forecast a mild recession by the end of the year. Professor Randall Kroszner, a former Fed governor, forecast interest rates will peak at 5.5% and the bank will keep them higher for longer, he said at a University of Chicago Booth School of Business event on Tuesday.

Diane Swonk, chief economist at KPMG, also said at the Executives’ Club event that she expected a mild recession.

Rogers said cyclical stocks would do well, and added he was “all in” on US equities. He added that auto-related companies were “well-positioned” and that anything to do with housing and real estate would do “really well.” Rogers is also favoring advertising stocks and the leisure sector.

“Equities in America is the place to be,” he said, adding the nation always finds a way to bounce back from its problems.

He cautioned against Chinese markets due to a real estate bubble there and said Bitcoin prices could fall further.

“I don’t see any real value there,” he said of the cryptocurrency.

Chicago-based Ariel was founded in 1983. The firm sells mutual funds and other investment vehicles, with a focus on value investing.

(Updates with Rogers views on inflation and stock sectors)

More stories like this are available on bloomberg.com.