By Paulina Cachero

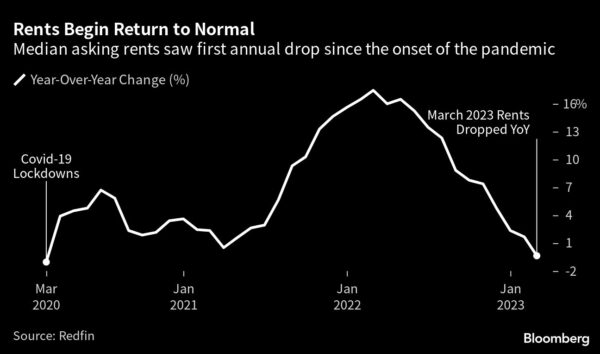

Rent in the US fell last month for the first time since March 2020, when the pandemic pushed much of the world into lockdown.

The median asking rent fell by 0.4% year-over-year to $1,937 — the lowest level in 13 months, according to real estate brokerage Redfin. It’s a dramatic shift from just one year earlier when prices surged nearly 18% and some renters were faced with bidding wars for apartments. Now, inflation, layoffs and growing fears of a recession are cooling demand.

Still, the median asking rent is $322, or 20%, higher than it was three years ago in the early days of the pandemic. While rents are falling, Redfin agent Dan Close said prices are simply returning to normal.

“It’s similar to the cost of eggs — you can say egg prices are plummeting, but what’s really happening is they’re finally making their way back to the $3 norm instead of $5 or $6,” said Close, who’s based in Chicago. “Rents ballooned during the pandemic, and are now returning to earth.”

The decline was largely due to a surplus of supply after builders rushed to meet demand during the pandemic housing boom, according to Redfin. In February, completed residential projects in buildings with five or more units jumped 72% year-over-year on a seasonally adjusted basis to 509,000. That’s the highest level since 1987 with the exception of February 2019. But those new units are often expensive and are coming on the market at a time when inflation has eaten away at purchasing power and people are staying put amid economic uncertainty.

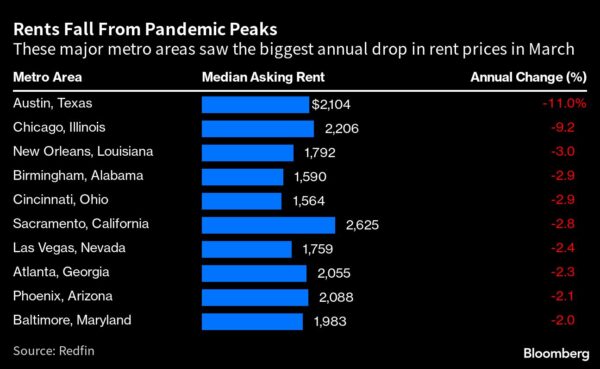

That’s particularly acute in Austin, Texas, where people flocked in droves during the pandemic, sending rents soaring. Now, rents in the pandemic boomtown are down 11% over the last 12 months.

More stories like this are available on bloomberg.com.