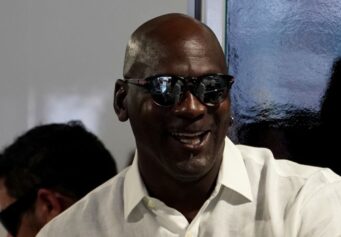

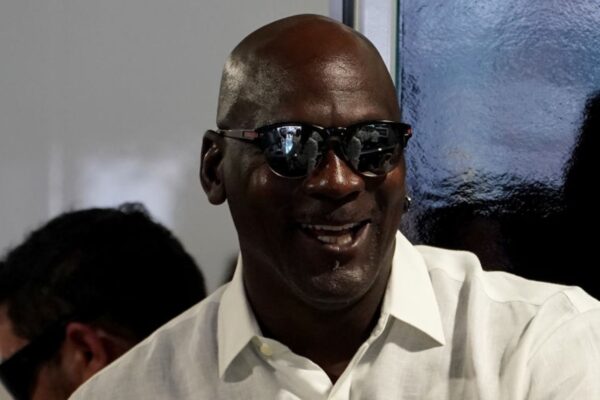

In a bold move that reshaped the landscape of endorsement deals, basketball legend Michael Jordan made a pivotal decision during the formation of his iconic Jordan Brand.

How the Jordan Deal Went Down

Rather than accepting a traditional signing fee in 1997, Jordan chose to take a 5 percent royalty payment, setting a new precedent in athlete-brand partnerships. This strategic move not only revolutionized the sports marketing industry but also solidified Jordan’s status as a savvy businessman, leaving a lasting impact on the world of sports and commerce.

The Air Jordan was officially released in 1984 when Nike launched the first signature shoe for Jordan, which eventually lead to the introduction of the Jordan Brand on Sept. 9, 1997.

Designed by Peter Moore, the Air Jordan 1 had a distinctive look featuring the iconic “wings” logo and Nike swoosh. Its original release included the “Bred” and “Chicago” colorways, with the former famously banned by the NBA because it didn’t conform uniform rules at the time.

Nike’s marketing capitalized on this controversy, launching a campaign centered around the slogan “Banned,” fueling the shoe’s cultural significance. Despite the ban, the Air Jordan 1 became a symbol of sneaker culture, influencing design and becoming highly sought after by collectors worldwide, according to a Medium page administrated by Steven Trinh, an author and fashion instructor at Stanford University.

On March 14, Boardroom posted on LinkedIn about MJ’s legacy as a businessman. The post highlights how taking a 5 percent royalty payment of the company was the greatest business move he ever made.

Thilo Kunkel, an expert on athlete brand development and monetization, told Temple University that at the time the move was revolutionary, but now more brands offer athletes company stock or equity stakes.

Instead of settling for a one-time payout, Jordan negotiated a royalty agreement that entitled him to a percentage of the revenue generated by the Jordan Brand. The strategic move allowed Jordan to capitalize on the long-term success and growth of the brand, ensuring a steady stream of income over time.

Nike has experienced remarkable expansion with its Jordan Brand, witnessing a significant surge in sales. From $2.8 billion in 2018, the brand’s annual sales steadily increased to $6.6 billion in 2023. Consumer demand for the Jordan Brand continues to grow, further solidifying its position as a leader in athletic footwear and apparel.

In 2023, Jordan’s 5 percent royalty agreement alone reportedly netted him a staggering $330 million, an immensely significant financial gain compared to his entire NBA career earnings of $94 million, according to sports entrepreneur and investor Joe Pompliano.

Besides eclipsing his substantial earnings as a professional basketball player, his Jordan Brand is the No. 2 shoe apparel in the world, surpassing sales figures of Adidas ($23 billion in 2023), Puma (roughly $9.43 billion), and New Balance ($6.5 billion) combined, second only to Nike itself.

Jordan’s understanding of the value of his personal brand and his adeptness at leveraging it effectively in business dealings has propelled him to extraordinary financial success.

Since October 2023, Jordan has been included in Forbes’ list of the 400 wealthiest Americans, with an estimated net worth of $3 billion. He holds the 379th position on the list, making him the first former professional athlete to achieve this milestone.