By Donald Moore and Heesu Lee

On Monday Twitter Inc. co-founder and chief executive officer Jack Dorsey announced he would be stepping down as head of the company, ceding control to chief technology officer Parag Agrawal. The stock dropped 4% on Tuesday to close at its lowest level since November 2020, and is down 21% this year.

The announcement marks the end of Dorsey’s second stint as CEO. He left the role in 2008 before returning in 2015. During the latest stint, he oversaw an attempted sale of the company, the decision to ban then-President Donald Trump from Twitter and battled an effort by activist investors to remove him from the job

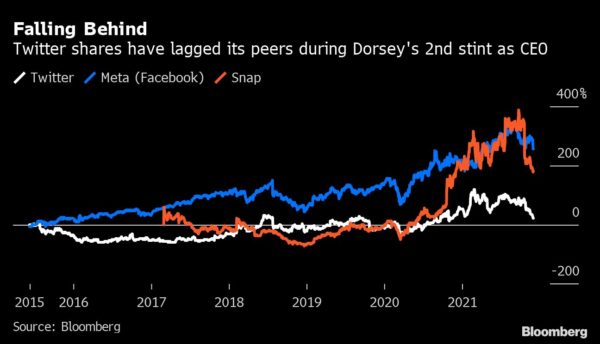

Agrawal will be charged with reinventing a company that has fallen behind its peers. While Twitter posted its first real yearly profit in 2018, its shares have been largely stagnant in recent years. Meanwhile, other social network companies such as Facebook owner Meta Platforms Inc. and Snap Inc. have seen explosive growth during the pandemic.

What’s next? Truist analyst Youssef Squali said that while Dorsey helped create a unique company that has proven nearly impossible for competitors to replicate, “user growth, engagement and the commercialization of the platform have proven much more difficult to nail.”

Even with new leadership, however, Squali advised investors to be patient. “Product innovation is the type of heavy lifting, which is likely to take years not quarters to materially affect the revenue trajectory,” he said.

Airline Turbulence

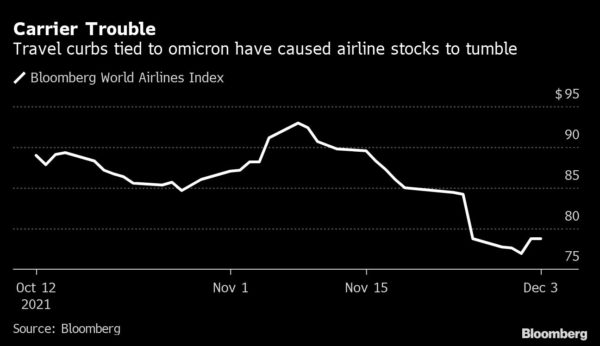

The emergence of the new Covid-19 variant, omicron, is taking a toll on the airline industry.

On Thursday the Biden administration announced new requirements on international air travel into the U.S. to mitigate the spread of the new variant. Airline stocks had already declined in anticipation of the restrictions. Delta Air Lines Inc. has fallen 8% since omicron was first reported to the WHO on Nov. 24, while United Airlines Holdings Inc. and American Airlines Group Inc. are down 11% and 10%, respectively.

Omicron is just the latest setback for an industry looking to recover from travel restrictions that had been in place for much of the pandemic. Updates from health officials on the new variant, however, have given some investors optimism that the newest wave of the pandemic might not be as severe as first feared.

What’s next? “Airline prospects are deteriorating as rising delta variant cases combine with risks that vaccines are less effective against the new omicron strain,” Bloomberg Intelligence analyst George Ferguson wrote in a note. “Holiday travel is mostly booked, supporting 4Q Europe and U.S. traffic, but the absence of business flyers hurts.”

Soured by Apple

Shares of Apple Inc.’s component suppliers took a tumble on Thursday after the smartphone maker warned of weakening demand for its iPhone 13 lineup. After LG Innotek Co. fell as much as 13% in South Korea and Japan-based TDK Corp. closed 4% lower on Thursday, European suppliers followed their Asian peers lower.

Apple had already lowered the production target for its iPhone 13 for this year by as much as 10 million units due to a lack of parts. In July, the company also warned that sales growth might slow with supplies getting tight. Like many of its peers, Apple is suffering from a global supply crunch and delivery delays.

What’s next? Raymond James analyst Chris Caso took a different view, saying he isn’t seeing significant changes to iPhone demand. He noted that it would be surprising for Apple to cut production given the supply constraints it faced at the beginning of the quarter.

Salesforce Selloff

On Tuesday after market close Salesforce.com Inc. gave revenue and profit forecasts for the fourth quarter that fell short of analyst estimates. The stock fell about 12% on Wednesday, its largest decline since March 2020.

The maker of cloud-based customer-relations software enjoyed a strong start to the year, as a hiring spree fueled increased corporate spending. But the disappointing guidance signals that some of the company’s clients may be wary of paying for new projects with a resurgent Covid variant. Other enterprise software makers have struggled, including Oracle Corp.

The forecast overshadowed what were otherwise strong results. Revenue increased to 27% to $6.86 billion, beating analyst estimates. The figure puts the company ahead of pace to hit its goal of $50 billion of revenue by 2026.

What’s next? Conservatism may have played a role in the lower-than-expected guidance, said William Blair analyst Arjun Bhatia. “Despite a few moving pieces this quarter, we remain positive,” Bhatia noted, pointing to strong performance in the core business, and a good start to the Slack integration.

Going for Groceries

Kroger Co.’s pandemic-fueled rally seems set to continue into 2022, with the grocery store chain reporting stronger-than-expected third-quarter sales. The stock climbed 11% on Thursday, its biggest gain since Nov. 2019, and shares are now up 40% this year.

Covid proved to be a boon for the grocer in 2021, as lockdowns shifted behavior from eating out to buying more groceries. Some investors were concerned that sales would decline amid a shift back to normal, but the strong results are a sign that the stay-at-home habits of consumers might be here to stay.

What’s next? Telsey analyst Joseph Feldman believes the retailer is on the right path, pointing to its push to expand its offering of fresh products and enhance digital features. Still “supply chain and other cost pressures are headwinds,” he wrote in a note, also indicating that concerns remain about the profitability of the company’s partnership with logistics firm Ocado Group.

More stories like this are available on bloomberg.com.